The Time Is Now For EV Batteries

The electric vehicle (EV) battery industry is poised to expand rapidly over the next few years and decades. Explosive growth in renewable energy, increased understanding of the dangers of climate change, and the ever-expanding impact of the cost of fossil fuels is driving more and more consumers to purchase electric cars. What does this mean for the manufacturers of those batteries and the regions they call home?

WHAT’S HAPPENING IN THE EV BATTERY MARKET NOW?

Because of the high barriers to entry and considerable technological sophistication required to play in the EV battery arena, the industry is dominated by about a half-dozen major manufacturers: LG Chemical, CATL, Panasonic, Samsung SDI, BYD, and SK Innovation

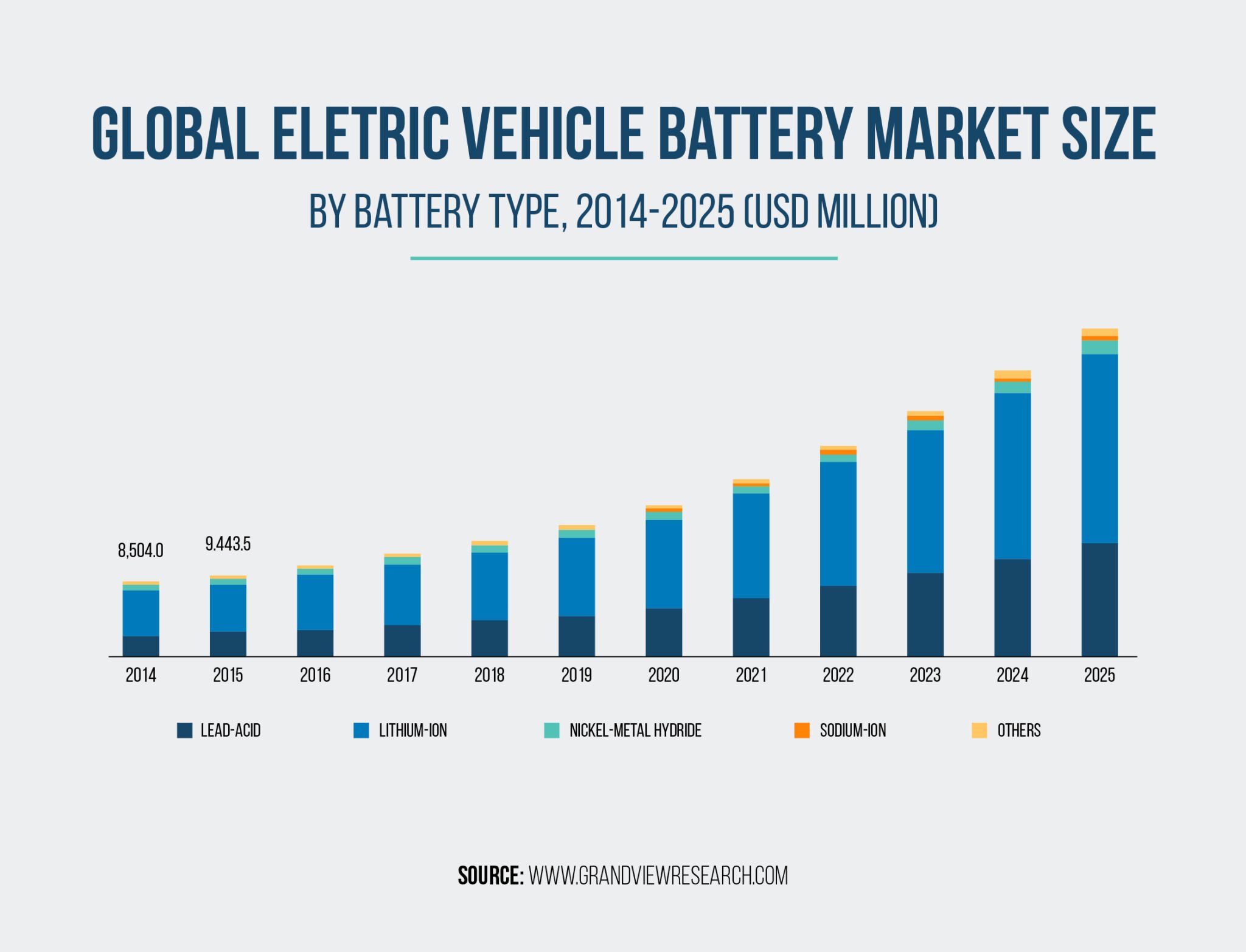

All of these large firms are well positioned to take advantage of what most economists and industry experts agree is likely to be a lucrative near-future for EV battery manufacturers. That’s particularly true for the fast-growing lithium-ion battery market segment, as illustrated in this forecast:

But you already knew that. So, let’s fast-forward to the latest interesting news!

The talk of the town is undoubtedly the proposed joint venture between Honda and LG. These two heavy-hitters have announced that they intend to open an EV battery manufacturing facility in the United States scheduled to be in operation by 2025. The anticipated factory is estimated to cost around $4.4 billion (US).

Mum’s the word on where exactly this mammoth facility would be located, but Honda already has large manufacturing footprints in Ohio, Alabama, and Indiana. We wouldn’t be totally floored if the new installation popped up somewhere near one of its existing factories. At the same time, Honda may be willing to ship the batteries some distance if it means getting access to some particularly generous incentives or government investments.

Toyota also recently announced that it would be investing about $2.5 billion (US) in additional EV battery manufacturing capability in the United States, specifically in North Carolina.

WHY IT MATTERS TO ECONOMIC DEVELOPERS

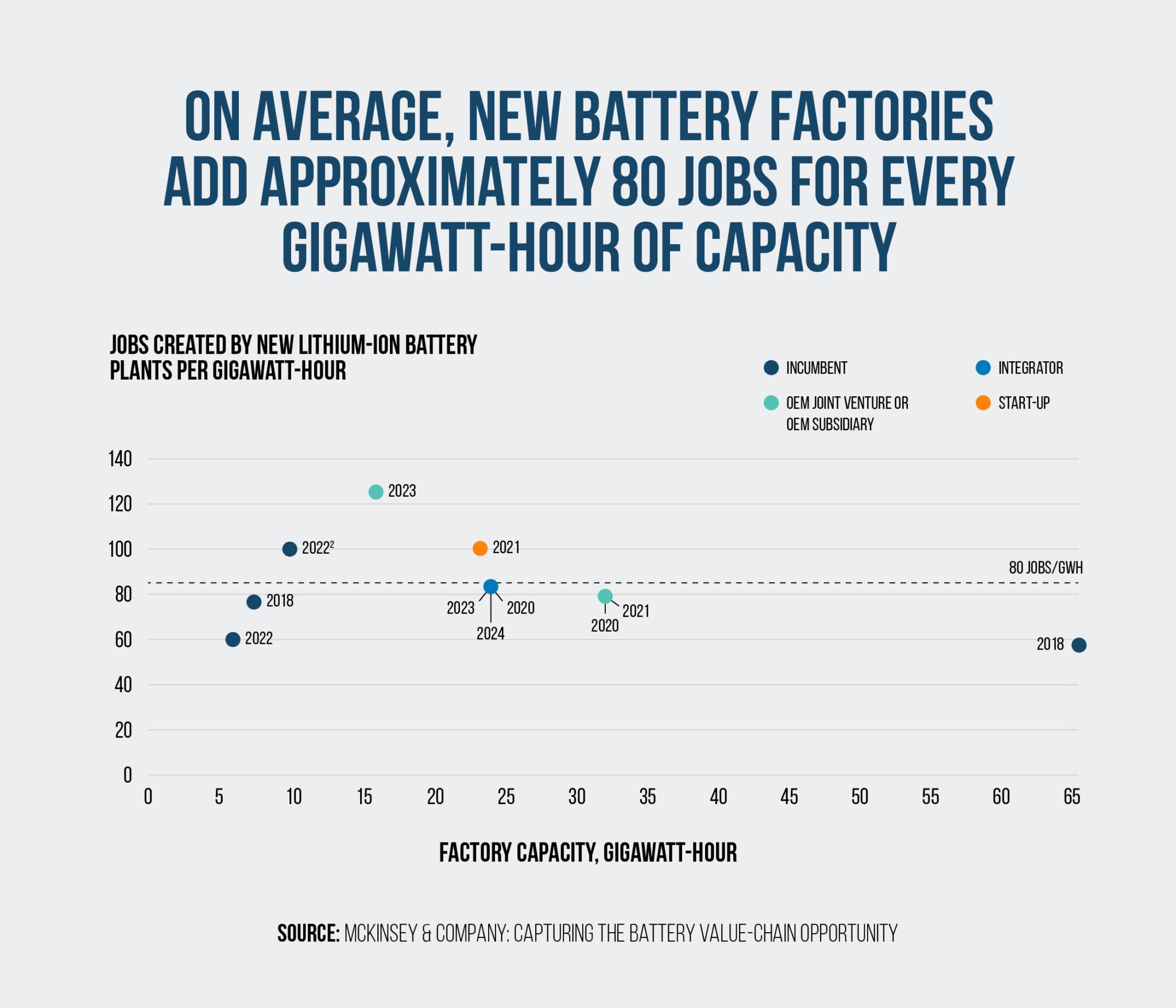

The logistics and specifics of these major deals matter for at least one simple reason: jobs. According to McKinsey & Company, new battery factories add up to 80 jobs to the local economy, per gigawatt-hour of battery capacity produced.

When one considers that the Honda-LG joint venture factory alone would produce over 40 gigawatt-hours of battery capacity per year – which would translate to approximately 3200 jobs – the rewards become obvious. What local, state, or federal politician wouldn’t want to take credit for bringing 3200 jobs to their jurisdiction?

On top of job creation, McKinsey & Co. estimates that, by 2030, 40% of the value creation in the EV battery supply chain will be found in manufacturing. In other words, the companies that can most effectively convert raw materials to working batteries – and the regions in which they locate their factories – will be best positioned to profit from the near-certain growth in the EV market over the next few decades.

IT’S POLITICS ALL THE WAY DOWN…

American foreign and trade policy is having huge impacts in the development and growth of the international EV battery market. And there are two main drivers of that influence at this time.

First, the United States-Mexico-Canada Agreement (USMCA) – the free-trade agreement that governs economic relations between the United States, Canada, and Mexico – contains significant numbers of clauses that require automobiles and automobile parts to be manufactured within the United States in order to benefit from a tariff-free or reduced-tariff status.

In other words, if you want to sell a car in North America without paying big tariffs when you move it across international North American borders, you’ll likely have to build some, much, or all of it in the United States. And that includes EV batteries. Given how large and economically important the combined US-Canadian-Mexican market is, major auto manufacturers will likely continue to seek to develop and maintain a large US manufacturing base.

Also, the recently passed Inflation Reduction Act contained several clauses making some US-manufactured electric vehicles eligible for major tax credits that could heavily influence American consumers. Auto builders who wish to make their vehicles eligible for these credits would have to build much of their cars, including the battery, in the United States.

WHAT WILL TOMORROW BRING TO THE EV BATTERY SECTOR?

EV battery factories are extraordinarily enticing prospects for economic development organizations. They bring high-tech, highly skilled, and high-paying jobs to any region they land in. They stimulate the development of adjacent economic activity in the form of automobile manufacturing, research and development facilities, raw material shipping and mining, and more. Perhaps most importantly (at a political level) is that all of these benefits are highly visible to the average voter.

For those reasons, we expect that responsible governments will continue to do everything in their power to attract these economic powerhouses. And that will mean ensuring that regions contain the resources, incentives, and investments that EV battery manufacturers look for when they’re deciding on a place to locate their next facility.

And what are those exactly?

Above all else, EV battery manufacturers need ready access to the raw materials they require to create their product. Nickel, cobalt, lithium and other metals come immediately to mind, for example. The quantity and cost of those materials in their local markets will heavily influence the desirability of a location in the eyes of an EV battery builder.

There are, however, significant ESG (environmental, social, governance) concerns related to the acquisition of these metals. (See, for example, this lengthy New York Times investigation of firms seeking marine nickel mining rights around the world.) Companies are increasingly finding that consumers and investors care a great deal about the environmental and social impacts of a firm’s economic practices:

Because of this new focus on corporate social responsibility, don’t be surprised if you see regions attempt to attract FDI in this industry by emphasizing the availability of environmentally responsible supply chains and socially progressive labor practices.

Just as important to the major EV battery players as ready access to raw materials is equally easy access to highly skilled labor. Manufacturing the latest and greatest in lithium-ion battery technology is no easy task, and it requires a lot of very smart, very educated people with fancy degrees. Regions that have many of these sorts of folks on-hand (or can readily attract them) will have an enormous advantage when competing with other areas that don’t.

Finally, favorable regulatory and legislative environments (and, if necessary, changes) will continue to attract the largest firms who wish to open their next EV battery facility. We’ve already discussed the importance of the USMCA and the Inflation Reduction Act, but here we’re talking more about the nuts and bolts of building, opening, and maintaining a factory. How easy (and expensive) is it to lease land? How friendly is the local tax regime?

EVERYONE WANTS THE NEXT EV BATTERY PROJECT

As EV battery makers jockey for position amongst themselves, EDOs hoping to grab a share of this market are rapidly running out of time. The value created by EV battery facilities is matched only by the ferocity of the regional competition hoping to land that next gigafactory. There’s no question about it. Anyone who wants to see that factory – and the jobs, money, and economic activity that comes with it – in their backyard will have to move quickly and aggressively.